Are State subsidies eveyone’s burden?

Posted by on Feb 15, 2020

This week on Facebook: The NHS¹ is no more guilty of holding the country to ransom than any of the ‘other’ subsidy that contribute to the government’s deficit financing policy. However, it does provide a simple answer to my question, “Are State subsidies everyones burden?”. For example I had occasion to attend A&E recently and had to wait until my local one opened its doors (it now closes during the night). My ‘accident and emergency’ was prompted by my dropping a drill on my foot. A&E offer a free service (in the sense no money changes hands), similar to freebies given by the nurse or doctor at the General Practice. My point is that neither is a ‘free’ service. Whatever the freebies provided, or time spent on the consultation — both influence fiscal policy.

Regardless of the form that subsidies take, their purpose is to alter the results created by otherwise free markets and unimpeded competition in a direction considered more consistent with the objectives of public policy. Subsidy — Britannica

Sir William Beverage wrote his welfare report in 1942², the Beverage Report made the assumption that the government play would promote full employment, that family allowances would be payable to all households with children (regardless of whether the parents were in or out of work) and thirdly a free, universal, National Health Service (NHS).

However there have been significant changed since the report was issued and public attitudes have changed any concepts of duties (if they ever existed) into those of rights. Certainly the notion of full employment that existed in the UK post WWII had fuelled the notion that the public, through taxation, had fuelled the tax revenue. This is not entirely untrue and remains so, in that fiscal policy currently relies on robbing Peter to pay Paul and that the welfare state is cost dependant. In practice the UK government always spends more money than it receives as revenue, the difference being made up by taxation, borrowing, quantitive easing, the further sale of public assets and other fiscal policies such as raids on pension funds (other than that of MPs).

I guess the real question that needs to be asked is what drives the objectives of public policy. While the simple answer could be assumed to be the public, the real answer lies with the public administration. Politicians seeking their own re-election and that of the party they support, may give deference to public opinion but they are always restrained by needs of their deficit financing policy, where and how these funding requirements are met becomes an issue for the public administration.

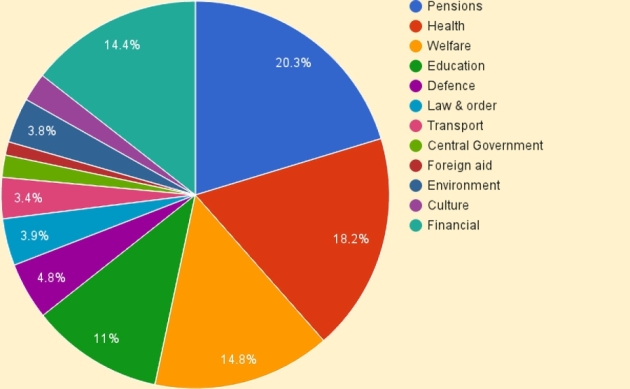

The largest of these ‘subsidies’ is pensions (1,2&3) with health (equating to the NHS) coming a close second (4) and welfare in third place. The other big section on there is “Financial” (5), at 14.4% with 6% of this being interest on the national debt (not included).

- economic growth every year for the next five years (1.2% this year, 1.4% in 2020 and 1.6% in 2021, 2022 and 2023)

- The 2019 figure has been cut from 1.6% in October 2018

- inflation to stay close to or at the 2% target

- 600K new jobs to be created by 2023

- unemployment to remain close to historic lows (the current 4% is the lowest rate since 1975)

- wages to continue to grow faster than inflation

Office of Budget Responsibility

On reviewing the articles this week, three out of the five are about pensions — as a pensioner that is probably right. It was a pension decisions that made me stay were I was. It is also something that is aways a future consideration. However, and inevitably, a pension is something that most of us come to rely on. The State financial deficit regards pensions as a source of income in that it inevitably claws back any subsidy.

The road to our brave new world of pensions has been a rocky one. Paved with best intentions, the journey ended, sadly too often, in scandal, u-turns and empty promises — potholed by political meddling and rising life expectancy. The Telegraph

1. The Pensions Primer: This Guide to the UK pensions system gives a detailed description of the current pensions system and some of the archaeology of these layers. The guide is intended for people wanting to learn about UK pensions policy. It should not be used to make individual pensions decisions.

2. Britain’s worst-off pensioners receive thousands of pounds less in state support than the richest: The State pension forms the bedrock of retirement finances for the majority of pensioners and these figures reveal just how much the poorest rely on it, as well as other benefits ranging from pension credit to the winter fuel allowance and are less likely to qualify for the full state pension. As lower earners, they could have failed to build up as much second or additional state pension (known as SERPS or S2P) before the single flat rate system was introduced in April 2016.

3. Pensions History: From an historical perspective, what is perhaps most notable about Britain’s system of providing its citizens with an income in old age (whether via a state, occupational, or private pension) is that the overall system has long existed in a state of almost perpetual revolution. This has had very profound consequences… Even experts struggle to understand all the system elements and, crucially, the many interlinkages between them. Ordinary mortals are simply bemused… We have the worst of all worlds: a complex and inefficient pension system already ill-placed to meet rising demand as the financial crisis and its aftermath produce a weaker economy that is struggling to generate the money to pay the pensions that people expect.

4. The NHS workforce in numbers: Despite the huge scale of its labour force, it is increasingly apparent that the NHS doesn’t have enough staff to meet demand. Here we lay out the facts – in so far as the existing data allow – on size and structure of the current NHS workforce. We highlight the extent of current shortages and their effect, and outline some of the workforce pressures that lie ahead.

5. The £93bn handshake — businesses pocket huge subsidies and tax breaks: The total emerges from the first comprehensive account of what Britons give away to companies in grants, subsidies and tax breaks, published exclusively in the Guardian.

Referenced Articles Books & Definitions:

- A bold text subscript above and preceding a title below (¹·²·³), refers to a book, pdf, podcast, video, slide show and a download url that is usually free.

- Brackets containing a number e.g. (1) reference a particular included article (1-5).

- A link (url), which usually includes the title, are to an included source.

- The intended context of words, idioms, phrases, have their links in italics.

- A long read url* (when used below) is followed by a superscript asterisk.

- Occasionally Open University (OU) free courses are cited.

- JSTOR lets you set up a free account allowing you to have 6 (interchangeable) books stored that you can read online.

¹Why The Health Of The NHS Depends On Growth And Reform (pdf) Between 1995 and 2015, the ONS figures show that inputs (cash) increased by an average of 3.9% per year, while output (services provided) increased on average by 4.7% per year. This means that on average, productivity in public healthcare increased by 0.8% each year over that 20-year period.

²10 things you may not know about the Beveridge report (url): He famously set out to slay five giants: Want, Disease, Ignorance, Squalor and Idleness. The report recommended a comprehensive system of social security to replace the mixture of private insurance and means tested dole that had existed before the war. It also made three basic assumptions about post-war society: a free and universal National Health Service; policies to promote full employment; and family allowances paid to all households with children regardless of whether they were in or out of work.

Comments are closed.